Invest in SME Park

The grounds are designed for industrial use for the production, storage, logistics, e-commerce. Conveniently divided into medium and small plots of land with road and utilities access.

Are you a micro, small or medium company?

To be considered as an SME, an entity must meet all the quantitative criteria listed below:

- employ less than 250 people

- have an annual turnover not exceeding EUR 50 M and/or

- have an annual balance sheet total not exceeding EUR 43 M

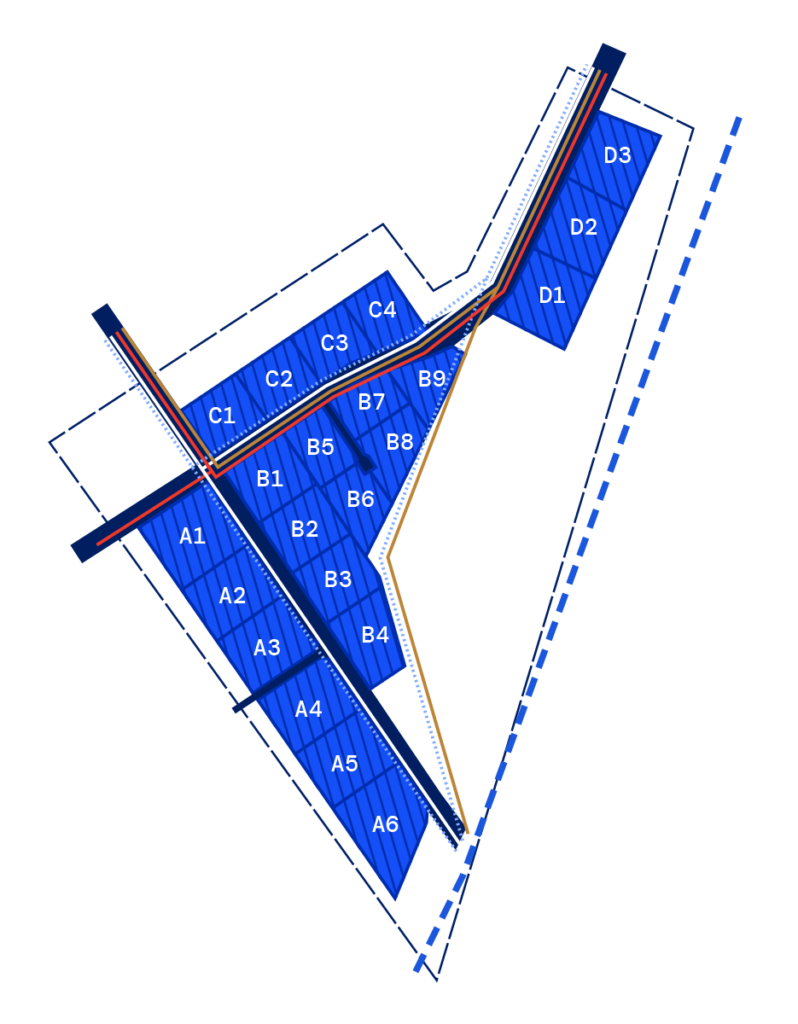

SME Park Area Map

Plots information

Area (in sqm)

- A1 – 12.651

- A2 – 10.463

- A3 – 10.500

- B1 – 8.677

- B2 – 8.677

- B3 – 8.678

- B4 – 8.677

- B5 – 6.763

- B6 – 7.024

- B7 – 6.403

- B8 – 7.345

- B9 – 6.232

- B10 – 4.291

- B11 – 15.165

- B12 – 16.456

- C1 – 7.481

- C2 – 7.481

- C3 – 7.480

- C4 – 7.481

- D5 – 9.397

- D7 – 9.471

All plots earmarked for investment by SMEs have the following specification:

Ownership

Municipal

Destination:

Production, Warehouses, E-commerce

Utilities:

Water, Sewage, Drainage, Gas Supply

Road:

7 m width tarmac road

Internet:

Yes

RET Exemption:

Yes

SEZ:

Yes

Ret Exemption

Investing in Stargard you can obtain real estate tax exemption for industrial investments. The time of the release depends on the capital expenditure. The period of real estate tax exemption depends on total value of investment.

You can obtain relief as follows:

- 3 years for investments between EUR 100 thousand – EUR 10 M

- 5 years for investments between EUR 10 M – EUR 50 M

- 7 years for investments over EUR 50 M

What does One Stop Shop stand for?

One stop shop we understand as a complex answer for all of your questions and doubts concerning investment process. To speed up investment process and overcome all obstacles on your way, we provide team of experts who offer support for your project in this full of paperwork time.

We can offer public data regarding environmental conditions, media, permits and others. At the beginning of the story, we set up timeframe in order to achieve all milestones at the scheduled time.

Special Economic Zone

Investors investing in Stargard are entitled to statutory tax reliefs and preferences. Tax exemptions in force in the PPNT are available thanks to the cooperation of the city with the Kostrzyn-Słubice Special Economic Zone. Thanks to this, investments are carried out in conditions that are comfortable for the investors and the relief in initial activity makes it easier for companies to start and run a business in Poland.

more information about KSSSE at the link: www.kssse.pl

We're waiting for you!

If you have a question for us, contact the PPNT advisors – we will dispel all your doubts and present options for cooperation in the development of your business.